Scalability Tradeoffs: Why “The Ethereum

Lately I’ve seen a lot of crypto-enthusiasts on Reddit and Telegram making comments like:

“Bitcoin is slow. It is expensive. There are many newcoins, modern ones that are much better. They are fast and inexpensive.”

Or the very popular CryptoKitties argument:

“Ethereum couldn’t even handle CryptoKitties, how do you expect it to be Web3.0?”

Or about how Blockhain X is here to turn the tables:

“<insert coin ticker>is king, it can handle 60,000 transactions per second, has no fees and it can do smart contracts”

The popular opinion is that the current leaders by market cap are not good enough, and that new projects are offering better features or alternative architectures (Tangle, Hashgraph) that are going to define a new standard and bring the capabilities of blockchains to new levels.

While I do not dismiss the possibility of Bitcoin being dethroned in the upcoming years, or that the top-5 might change radically in the future, I believe that we need to be skeptical when a project advertises itself as a do-it-all solution, and rigorously investigate it before jumping to conclusions.

There is no silver-bullet that will solve all problems.

“Touka Koukan” (等価交換) is a Japanese phrase which roughly translates to “equivalent exchange”. Nothing comes for free. There will always be trade offs.

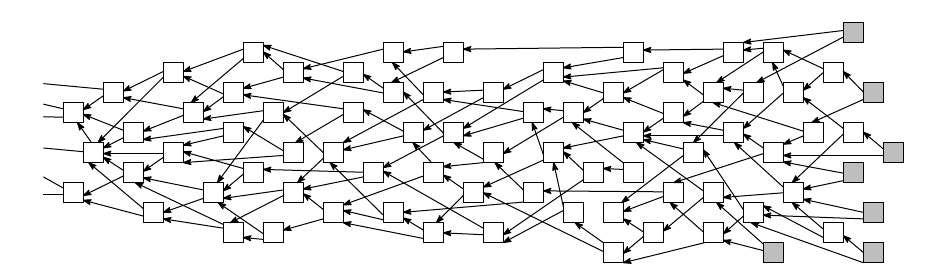

Below is the Scalability Trilemmaas described by Vitalik Buterin:

From https://github.com/ethereum/wiki/wiki/Sharding-FAQ

Α blockchain that claims to have solved the trilemma has either bent the laws of physics (highly unlikely), or it has discovered a breakthrough method that solves the major blockchain scalability problems that have stumped top mathematicians and computer scientists for the past decade.

While this is not impossible, a more likely explanation is that the blockchain has sacrificed either decentralization, security, or both.

What characterizes a blockchain or a cryptocurrency?

What characterizes a blockchain or a cryptocurrency?

In my debut article, A rant about Blockchains I provide the following definition of a blockchain:

A blockchainis a database that can be shared between a group of non-trusting individuals,without needing a central party to maintain the state of the database.

And cryptocurrencyfrom Google dictionary:

A digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank.

Note that both definitions (blockchain and cryptocurrency) emphasize the need to operate independently of a central party.

The case against (semi-)centralized coins

Ripple

XRP claims to be “the fastest and most scalable digital asset, enabling real-time global payments anywhere in the world.” They boast that “XRP consistently handles 1,500 transactions per second, 24x7, and can scale to handle the same throughput as Visa.”

However, let’s compare XRP’s nodes number to Ethereum and Bitcoin:

425 Ripple Nodes around the globe | https://xrpcharts.ripple.com/#/topology

11,690 Bitcoin Nodes | https://bitnodes.earn.com/

32,383 Ethereum Nodes https://www.ethernodes.org/network/1

In addition, Ripple can freeze its users’ funds at any given time[1][2].

It may be fast, but Ripple is as centralized as it gets.

Masternode Coins

A Masternode is a full cryptocurrency node which can perform extra functions in its blockchain network such as:

- Participate in governance and voting

- Instant transactions

- Private transactions.

It is used in cryptocurrencies like DASH and PIVX.

In order to be able to run a masternode, you need to put up some amount of cryptocurrency as collateral — like stake in Proof of Stake — to disincentivize malicious behavior. In return, you get compensated with a cryptocurrency payout at regular time intervals.

The aforementioned features are great, however:

- A DASH masternode costs 1,000 DASH ($1,000,000)

- A PIVX masternode costs 10,000 PIVX (~$110,000)

The high financial barrier of entry translates to a certain degree of centralization which as discussed before, breaks the requirement of decentralization.

In order to maintain decentralization there needs to be a low barrier of entry for individuals to join and contribute to the network — This directly relates to the Bitcoin Civil war for the block size increase.

Permissioned or Private Blockchains

I will skip over this category completely since by definition this is a centralized setup. A highly recommended comparison on Public vs Private blockchains can be found here.

I also want to emphasize that a blockchain claiming to achieve a high number of transactions in a testnet does not mean that performance will translate if/when it is deployed as a public blockchain.

Zero / Ultra Low transaction fees

What if a coin claims to have zero transaction fees?

In order to keep the network secure, there is a need for verifying entities who create new blocks and maintain the network.

Why would these entities support the network and not try to attack it?

There needs to be an incentivizing method for them to do this task honestly without trying to game the network. That incentivizing method is transaction fees and block rewards. Since block rewards are slowly diminishing (e.g. block reward halving in Bitcoin) miner incentives are directly linked to transaction fees.

It is impossible to have a truly decentralized network with 0 fees as there would be no incentive to maintain it.

What about coins that have ultra low transaction fees?

I will rebut this argument with an example from Ethereum:

An Ether transfer costs 21,000 gas. Let’s say you want your transaction to be confirmed fast, so after consulting ethgasstation.info you set the gas price at 50Gwei/gas, resulting in total transaction fees of 0.00105 Ether.

If you made the transaction in Jan 13, 2018 (Ξ1=$1,400) it would cost $1.47.

If you made the transaction in Jan 15, 2017 (Ξ1=$10) it would cost $0.01.

Transaction fees (given that the calculation method stays the same) are constant when denominated in the native currency (Ξ1=Ξ1 always). A multifold increase in a coin’s price, implies a multifold increase in transaction fees when denominating in fiat currency.

When arguing that Coin X has $Y transaction fees when evaluated at $Z per coin, think about what Y will be if Z becomes 100*Z.

Corollary: Most coins that claim to be cheaper than Bitcoin or Ethereum can only do so because they have very low transaction volume.

The increase of a coin’s price and transaction volume are positively correlated with an increase in that coin’s transaction fees.

Consensus Algorithms

Both Bitcoin and Ethereum use Proof of Work, the most widely-used consensus algorithm since the inception of cryptocurrencies. If you are not familiar with how Proof of Work and consensus algorithms I refer you to my previous articles [1][2]

There have been many attempts at alternative Proofs of {Something} in order to tackle the deficiencies of PoW, most notably with Proof of Stake.

Taking Bitshares or Steem as an example, they both use Delegated Proof of Stake (DPoS) as their consensus algorithm (not to be confused with Cardano’s DPoS algorithm).

Think of DPoS as representative democracy. Instead of voting directly on an issue (on a block), you delegate your voting power to trusted “delegates” who will use that power to take a decision (mine a block) for the masses. This in turn allows less overhead and enables much higher transaction throughput. However, it is less decentralized because there are only a handful of delegates who hold the majority of the decision-making power, and power is corruptible.

There are valid use cases for DPoS: Steemit, for example, is a successful platform with performance comparable to traditional web servers, despite running on its own blockchain. Most of its value transfers are micro-transactions, so sacrificing decentralization and security is a fair tradeoff to make in order to achieve such high levels of scalability and performance.

However, for a cryptocurrency storing large amounts of value, or a platform that handles smart contracts that must be trusted by third parties, it is far more secure to use a fully decentralized PoW chain.

At Loom Network, we think blockchains like this are best implemented as application-specific sidechains, where the sidechain security is maintained by the main chain.

What about Tangle or Hashgraph?

Tangle

IOTA uses a totally different system from a blockchain, based on a Directed Acyclic Graph (DAG), called the Tangle.

Essentially the Tangle’s transactions have no timestamps (which means you cannot do complex smart contracts on them which rely on X happening before Y) and they tackle the double spend problem by referencing two previously confirmed transactions.

https://iota.org/IOTA_Whitepaper.pdf pg.10

This looked particularly promising until MIT Researchers found a critical vulnerability in the curl hash function that IOTA created. Additionally, the IOTA foundation (like Ripple), has also frozen user funds in the past.

Also since this is a fee-less system, as discussed before, there is no incentive to run a full node.

Hashgraph

Hashgraph is also a relatively new concept which is described in depth here:

Recently, on our Zilliqa social channels a number of people have asked us to take a look at Hashgraph. So, here is what…hackernoon.com

However, as said by the Hashgraph team in their Telegram channel, it is currently deployed only in a permissioned network. This again breaks the requirement for decentralization since it’s private; however, it might have a valid use case in corporate environments. It is probably too early to know if it will find its way to public networks.

Conclusion

My previous arguments are aimed towards the politics and the proper design of community-driven blockchains.

I do not believe that XRP, Masternode coins and private blockchains are cursed and should be avoided. Each has its use case.

However, they are inherently more centralized and should not be mistaken for a truly decentralized, impossible-to-censor and unstoppable cryptocurrency.

Regarding new experimental algorithms and network topologies, I really hope they are able to sustain the scalability they claim they can achieve, without ultimately sacrificing decentralization or security.

It’s too early to get overly excited about these platforms (and declare them the “Ethereum killer”) until they have proven themselves at scale.

Further reading:

[1] The Meaning of Decentralization.

[2] Blockchains don’t scale. Not today, at least. But there’s hope

[3] Tradeoffs in Fault Tolerant Protocols

原文: https://medium.com/loom-network/scalability-tradeoffs-why-the-ethereum-killer-hasnt-arrived-yet-8f60a88e46c0

Scalability Tradeoffs: Why “The Ethereum相关推荐

- 可伸缩性, 可用性和稳定性模式 Scalability, Availability Stability Patterns

Scalability, Availability & Stability Patterns 一 自我有要求的读者应该提出问题:(研习:掌握层次:)能力级别:不会(了解)--领会(理解)--熟 ...

- 白皮书 | 以太坊 (Ethereum ):下一代智能合约和去中心化应用平台

当中本聪在2009年1月启动比特币区块链时,他同时向世界引入了两种未经测试的革命性的新概念.第一种就是比特币(bitcoin),一种去中心化的点对点的网上货币,在没有任何资产担保.内在价值或者中心发行 ...

- 以太坊区块链Ethereum开发资料汇总

2019独角兽企业重金招聘Python工程师标准>>> 基本概念介绍 :国内介绍区块链比较详细的资料 终于把区块链的技术与应用讲清楚了 http://business.sohu.co ...

- 如何扩大以太坊的规模:分片简介(How to Scale Ethereum: Sharding Explained)

2019独角兽企业重金招聘Python工程师标准>>> 分片是提高区块链效率的一个主要流派.下面简单通俗的解释一下分片算法. 以太猫(Cryptokitties)堵塞了以太坊网络好几 ...

- 以太坊Ethereum存储和数据结构 图示

下图表示以太坊的世界状态前缀树.实现源码可以在这里下载:https://github.com/liangyihuai/understanding_ethereum_trie 这个链接的readme文件 ...

- 使用Ethereum C++ Aleth客户端创建具有两个同步节点的以太坊Ethereum私有网络

Creating A Private Network With Two Syncing Nodes 本文是前面两篇文章的延续,链接分别为:Windows10安装Aleth和使用Ethereum C++ ...

- 我自己可以挖矿了!使用Ethereum C++客户端Aleth建一个私有网络,并使用Remix部署一个智能合约

本文是按照这个教程执行的结果记录:Creating a private network and deploying a contract with Remix Ethereum Aleth在Wins上 ...

- Windows10编译源码安装Aleth(Ethereum C++ client, tools and libraries)

这篇文章记录本人安装Ethereum c++客户端Aleth的过程. 本人的系统环境 本人系统:windows10, 64bit, 预先安装: visual studio 2017或者2019.本人的 ...

- Ethereum 君士坦丁堡安全漏洞对 FOD 的影响

FOD 与 Ethereum 的前世今生 FOD 是 FIBOS 生态中的稳定币,与 USDC 1:1 锚定,其服务于需要稳定价值衡量的应用场景.FOD 通过跨链网关将 ETH 链上的 USDC 与 ...

最新文章

- python视频口碑佳_从万众期待到口碑扑街!用Python来分析一下大家对唐探3的评论...

- SpringBoot是如何解析HTTP参数的?

- jax-ws和jax-rs_JAX-RS和OpenAPI对Hypermedia API的支持:任重而道远

- 20165234 《Java程序设计》第五周学习总结

- am335x reboot 命令分析

- LeetCode 6060. 找到最接近 0 的数字

- linux内核支持2t,Linux 支持2T磁盘分区

- 测网速还能拿奖励?测速 App 的新玩法

- 滴滴又出事!33项问题被查,程维再次致歉

- 弹窗样式 idialog,purebox,artdialog4.1.2,jquery.alert.v1.2

- python语句命令的概念_Python学习笔记1-基础概念

- 设计模式(行为型模式)——模板方法模式(Template Method)

- Pytorch——计算机视觉工具包:torchvision

- 评人工智能如何走向新阶段?

- 【算法升级】仅有85K个参数的开源人脸检测算法

- pythontkinter教程_Tkinter简明教程

- Java常见异常和解决办法

- Proteus仿真51单片机

- LayerCAM:Exploring Hierarchical Class Activation Maps for Localization

- 动态箭头gif图标_教程|PPT绘制箭头最全攻略,收藏一下